Share market

News

# High Return Stocks, #Best Stocks for Investment, #BSE Listed Stocks, #Elcid Investments Ltd, #Indian Stock Market News, #Invest in Penny Stocks, #Latest Stock Market Trends, #Multibagger Stocks India, #NSE BSE Stocks to Watch, #sharemarket, #Shares That Give Huge Returns, #Shares with 1000% Return, #Stock Market Analysis India, #Stock Market Tips India, #Stocks That Increased 50000 Times, #Top Penny Stocks 2024

ZeroToHero

0 Comments

₹10,000 investment became ₹94 crore: Elcid Investments Ltd’s amazing returns and stock market stir

Alcid Investments Limited: A Unique Success Story

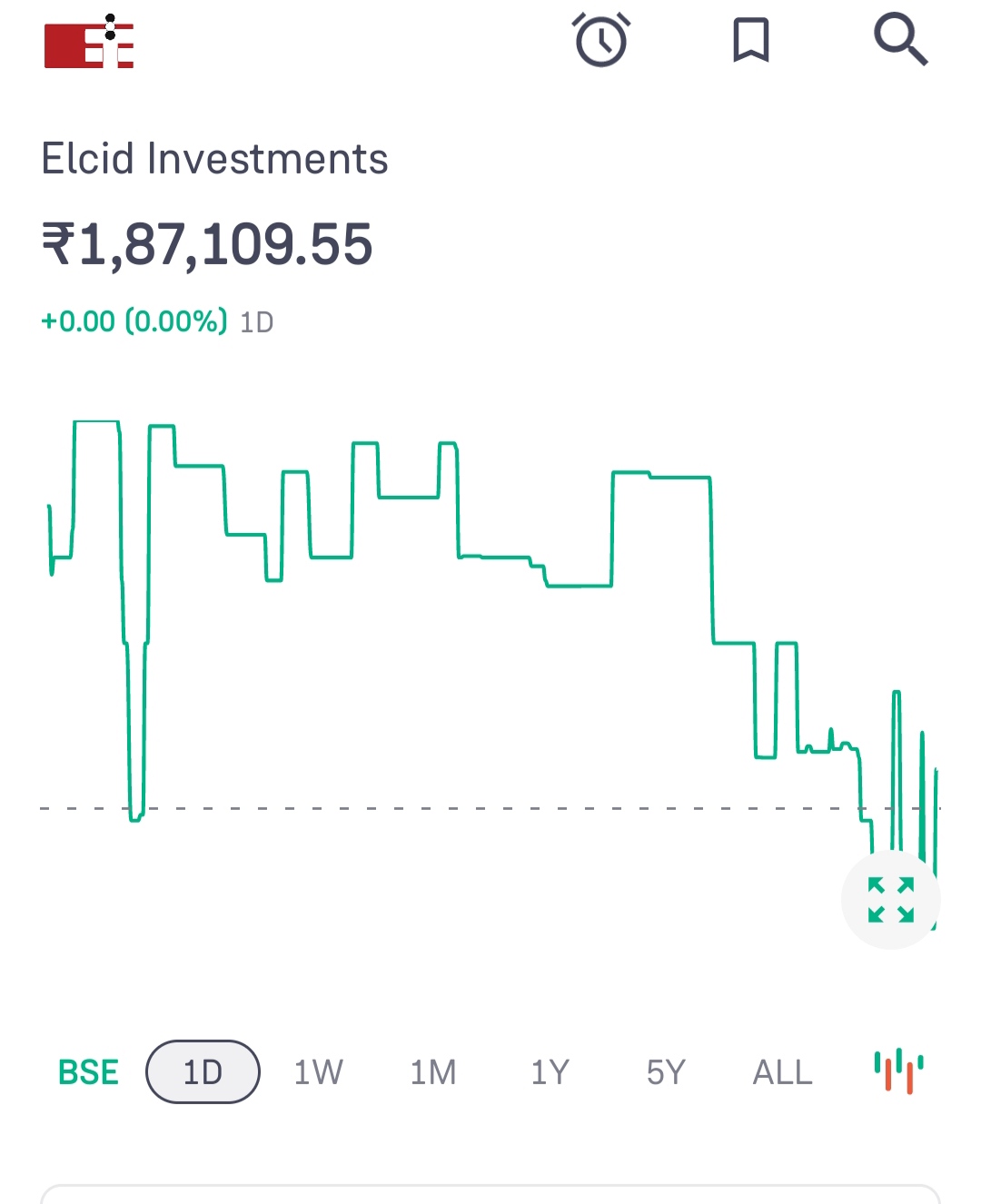

Shares of BSE-listed investment company Elcid Investments Ltd have provided a staggering return to its investors this year, making it an attractive investment option for many investors so far. The stock of this company has given a return of 55,751 times within just 6 months this year, turning an investment of ₹ 10,000 into ₹ 94 crores. With this, the market cap of this stock has reached Rs 3,804 crore, establishing it as a small but highly influential company.

Company structure and shareholder status

The structure of Elcid Investments Ltd is quite unique. At the end of the September quarter, the company had only 322 public shareholders, of which 284 were retail investors who held shares worth up to Rs 2 lakh. This figure indicates that the number of shareholders of the company is very limited, but still the company’s shares are witnessing huge fluctuations.The most interesting thing about this is that the total shareholders of the company along with 6 promoters were only 328, and the public had only 50,000 shares, which represents 25 percent of the total company. In such a situation, when the share price increased, these limited number of investors got great profits.

What is the reason for this amazing return?

How this extraordinary return came in the shares of Elcid Investments is an interesting question. Actually, the company’s shares were trading at a very low value for a long time, and in the last few years it was trading around Rs 2-3 per share. However, in mid-2024, there was an unexpected surge in the company’s shares. The main reason for this could be an action taken by SEBI.

Role of SEBI and impact of special auction

In June 2024, SEBI announced special call auctions for listed investment companies (IC) and investment holding companies (IHC). SEBI found that there was a huge difference between the market value of the shares of these companies and their book value, which could cause losses to investors and increase market volatility. Notably, the shares of these companies sometimes traded at low prices, which were much lower than their actual value.In response to this, SEBI initiated the process of special call auctions without a price band. The aim was to determine the fair value of the shares of these companies and increase their liquidity. This action affected the shares of Alcid Investments and on October 29, 2024, the company’s shares jumped by about 67,000 percent. Subsequently, the share price reached ₹3,32,399.95 by November 8, 2024, turning an investment of ₹10,000 into ₹94 crores.

What happened next?

However, this extraordinary surge was followed by some profit booking, and the stock price declined. Nevertheless, this extraordinary return turned out to be a memorable experience for investors. Currently, the stock has hit an intra-day high of ₹1,93,900.50 last Friday, which is still a fantastic value.

What is the lesson for investors?

There are several important lessons for investors from this incident:

- Valuation of shares The value of a company’s shares depends not only on its current turnover but also on its book value and liquidity. SEBI’s action proved that sometimes the value of shares can be much lower than their actual value, and understanding this difference can benefit investors greatly.

- Investment opportunities One of the big advantages of investing in small but influential stocks like Elcid Investments Ltd is that these stocks can suddenly give very big returns, as happened in this case. However, it can also be risky, as sometimes such stocks can also see extreme volatility.

- Financial position of the company It is very important to understand the financial position, operating model and management strategies of any company before investing in its shares. In the case of Elcid Investments, the company had limited shareholders and low trading volumes, but its value increased after SEBI’s intervention.

conclusion:- This extraordinary return in the shares of Elcid Investments Ltd has once again reminded investors that from time to time such opportunities may arise in the stock market, which can lead to very large profits. However, it is also true that investing in such shares can be risky, and investors should consider them only on the basis of their risk tolerance and financial plan.One thing is clear from this incident that to get big returns in the stock market, sometimes unusual circumstances have to be taken advantage of, but before that investors should take every step thoughtfully.

Disclaimer:- This article is for informational and educational purposes only. The information provided herein is not financial, investment or any other type of advice. Please consult your financial advisor or professional before investing, as investing can have risks. Any investment may result in profit or loss due to market fluctuations. Use your own research and discretion before making any decision related to the companies, stocks and events mentioned in this article. The author or the website will not be responsible for any losses arising from any investment decision.

Post Comment