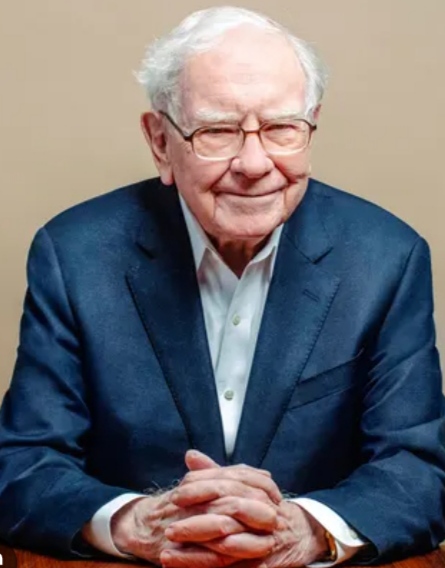

“Warren Buffett 2025: The Powerful Legacy of the World’s Simplest Billionaire”

The year is 2025, the world is looking for a future in Artificial Intelligence, space tourism and climate tech. But there is one name that is still shining like a beacon in the world of finance and investment – Warren Buffett. He is 94 years old but his influence is still very relevant today. Let us find out why Buffett is not just an investor but has become a thinker.

Warren Buffett: A glance Warren Edward Buffett, known to the world as the “Oracle of Omaha”, began his investing journey at the age of 11. As the CEO of Berkshire Hathaway, he invested in the stock market for decades in a way that is still textbook examples.His mantra was simple: “Invest in companies that make sense, have long-term growth and are well-managed.”

What is his status in 2025? Warren Buffett is officially no longer an active CEO in 2025, but his strategic guidance is still heard in Berkshire Hathaway’s board meetings. Greg Abel is his successor, but Buffett’s presence is like that of a mentor.Berkshire Hathaway’s holding companies – Apple, Coca-Cola, Bank of America, and most recently Tesla Energy – are still the result of Buffett’s long-term thinking.

Warren Buffett’s top learnings that are still valid in 2025:

Patience is Profit:Buffett never ran after short-term returns. He used to say, “Stock market is a place where money is taken from people who have patience and given to them.

“Circle of Competence:Buffett only invested in businesses whose fundamentals he understood well. He stayed away from crypto and tech bubbles because he used to say – “If you don’t understand the business model, then don’t invest money in it.”

Frugality and Discipline:Despite being a billionaire, Buffett kept his old car, Omaha house and the same daily routine. His simplicity was his strongest USP.

What is Buffett’s relevance to the youth of 2025? For today’s new investors, who are interested in crypto, NFTs, and high-risk trades, Buffett is both a cautionary tale and an inspirational figure. Even today his “Value Investing” model is taught in business schools.For Gen Z and Gen Alpha whose investing journey begins with apps, Buffett’s message is clear – “Easy money ends fast. True wealth takes time.”

Berkshire Hathaway’s current portfolio (2025 snapshot):

Apple Inc.: Still the largest holding, even with AI revolutions.

Tesla Energy: Investment starts from 2023; focus on renewable energy.

Amazon Web Services (AWS): Strategic buyout post-2024 restructuring.

BYD (China Electric Vehicles): A part of the Global EV strategy.

Occidental Petroleum: Buffett takes position on transition from fossil fuels.

Buffett and AI: Many people wonder why Warren Buffett is staying away from complex technology sectors like AI. His answer was:

“I don’t underestimate the future of AI, but until I understand the core revenue model of a business, I don’t invest money in it.

“Ironically, Berkshire is now investing in AI-backed insurance analytics firms – but only after solid proof-of-concept.

Some evergreen quotes of Buffett which are still a hit today:

“Be fearful when others are greedy, and greedy when others are fearful.”

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

“Price is what you pay. Value is what you get.”

Philanthropy and Giving Pledge:

Buffett promised to donate most of his money to charity in 2010. By 2025, he has already donated 85% of his estimated $130 billion wealth.

Together with Melinda French Gates and nu-leader Marcus Chan, he is now working to promote global education and health.

Buffett’s view on India: Buffett has not made much direct investments in India, but has had exposure through indirect shares in Paytm, Zomato, and Reliance Jio. In 2023, Berkshire took a minority stake in Tata Power Renewables – a move that reflected his interest in India’s clean energy future.

Will investors like Buffett still exist in the future? In today’s AI-driven, algo-trading dominated world, investors like Buffett are becoming less and less. But his model is timeless:

Simplicity

Long-term vision

Ethical investing

Human judgment > machine instincts

Conclusion: Warren Buffett is not just a billionaire, he is a school of thought. His way of life, investing philosophy, and passion for making the world a better place are all sources of inspiration for today’s investors.If you want to learn from him in 2025, learn not just about stocks but also about patience, humility, and wisdom.Warren Buffett is alive, relevant, and will always be – as an idea.

Disclaimer: This article is for general information and educational purposes only. The views and opinions expressed are the author’s own and are not intended to be any kind of financial, investment, or legal advice. Readers are advised to consult their financial advisor before making any financial decisions. The facts presented in the article are based on trusted sources, but IN2025News does not guarantee the accuracy of any third-party data.

Post Comment