Costco Stock Price 2025: Is Now the Right Time to Invest?

Introduction – What is Costco? Costco Wholesale Corporation is an America-based retail company that operates membership-based warehouse clubs. People here buy groceries, electronics, home goods, and many other things in bulk at affordable prices.

Costco stock is giving a very strong performance in 2025. Let’s see what is the current price, how much dividend is being received, and what is the future investment potential.

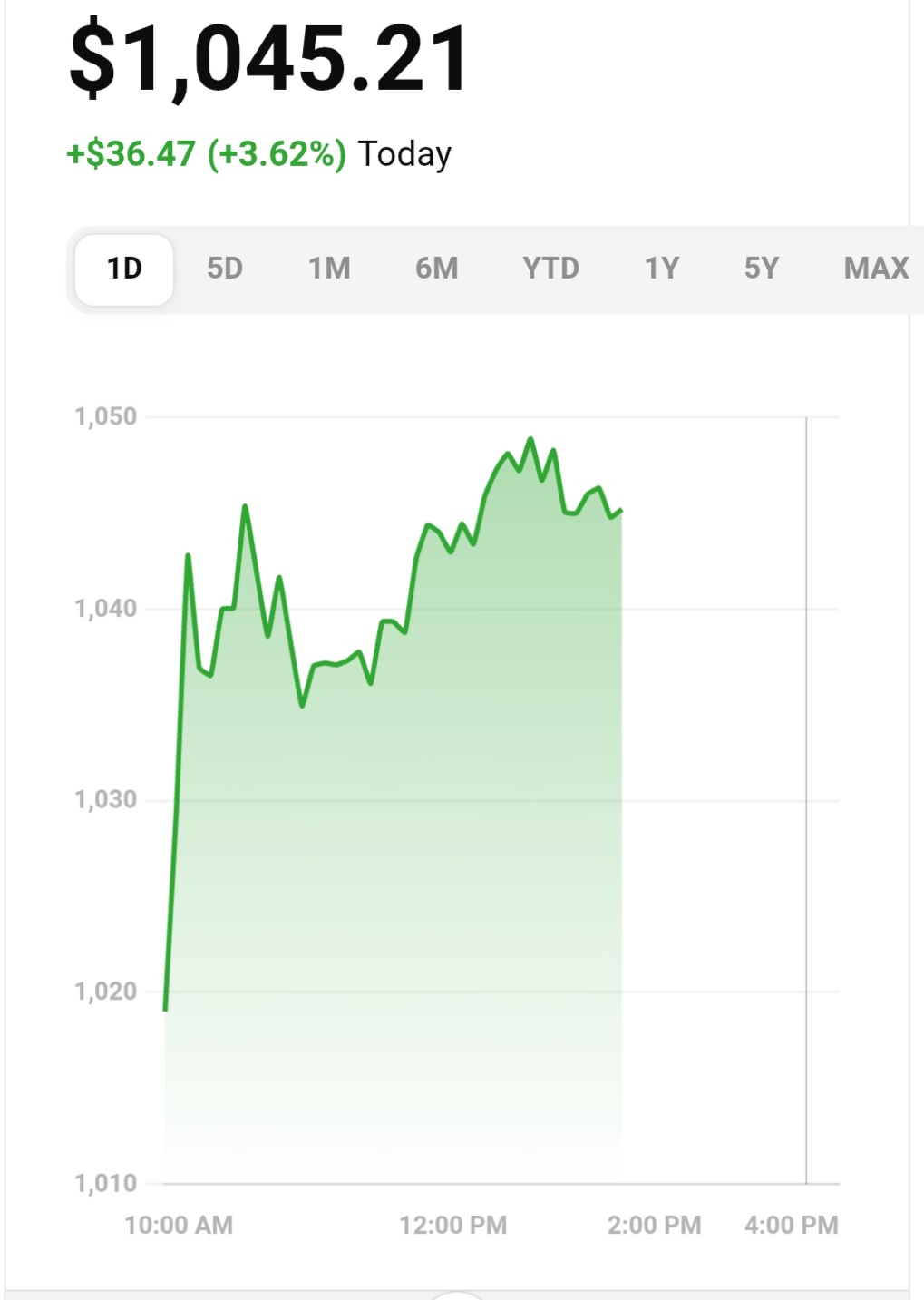

📈 Costco Stock Price (As on May 30, 2025)

Current Stock Price: $1,045.21 USD

1-Day Change: +$36.47 (↑ 3.6%)

52-Week Range: $788.20 – $1,078.24

Market Cap: Approx $447.56 Billion

Costco stock is in continuous growth from the end of 2024 to 2025. Investors have strong confidence because the company’s business model is stable and profit-generating.

💰 What is Costco’s Dividend? Annual Dividend: $5.20 per share

Dividend Yield: 0.51%

Payment Frequency: Quarterly (Every 3 months)

Last Dividend Paid: $1.30 per share on May 16, 2025

Dividend Growth History: Dividend has been increasing continuously for 22 years

This steady dividend is a sign that the company is financially strong and believes in giving value to the shareholder.

💼 Costco’s Financial Results (Q3 FY25)

EPS (Earnings Per Share): $4.28 (13% YoY growth)

Revenue: $63.2 Billion (8% growth)

Same-store Sales Growth: 5.7%

US Sales Growth: 6.6%

These numbers show that despite inflation, Costco is attracting customers. Strong revenue and profit margins mean the stock is still in a growth phase.

📊 What do analysts say?(Exper Ratings)

CFRA Research: Target price increased – $1,130

Morgan Stanley: Bullish view – Target $1,225

DA Davidson: Hold rating – Target $1,000

Experts say that Costco’s low debt and high efficiency make it recession-proof. Import dependency is also low, which gives an advantage in global uncertainties.

🔧 Company’s Strategic Moves – Future Planning

1. Scan-and-Go Checkout Option Costco is testing new scan-and-pay technology, which will make billing faster and smoother – like it happens in Amazon and Walmart.

2. Supplier Partnership The company is working together with suppliers to optimize costs – which reduces the impact of inflation and tariffs.

3. E-Commerce Growth Costco is also aggressively growing online sales and delivery options, which could boost stock price in the long term.

📚 What is the signal for long-term investors?✅ Pros:

Strong brand loyalty

Consistent dividend

Stable revenue even in economic downturns

Cost-efficient business model

⚠️ Cons:

High stock price = Entry can be expensive

Dividend yield is low (but consistent)

If you are a long-term investor who wants growth and a little dividend, then Costco can be a solid option.

🔮 Prediction till the end of 2025? If the current trend continues, analysts are giving a target price of Costco between $1,100 – $1,200.

But keep in mind:

The stock market is not free from risk. Every investor should take decisions according to his risk tolerance.

📝 Summary Table – Costco Stock at a Glance

Parameter Value stock Price (May 2025) $1,045.21

Dividend Per Year $5.20

Dividend Yield 0.51%

Q3 EPS $4.28

Revenue (Q3) $63.2Billion

Analyst Target. $1,100 – $1,225

Investment Type. Growth + Low Dividend

📌 Final Thoughts – Should you invest in Costco?

If you want to invest in a safe, stable and trusted retail brand with a solid long-term dividend and growth record, Costco can be a good choice.

But the high price entry can be a bit risky in the short-term – so consider investing through SIP style.

Disclaimer: All the information given in this blog is for educational and general information purposes only. The views, analysis and figures shared here are based on the author’s research and should not be taken as investment advice.We are not a SEBI-registered financial advisor. Consult your financial advisor before making any stock or investment decision. Investing in the stock market is subject to risk. There is a possibility of profit, but losses can also occur.Every effort has been made to ensure that the information given in the blog is accurate and up-to-date, but we are not responsible for any losses.

Post Comment